defer capital gains tax uk

Instead people are expected to claim UC or pension credit if appropriate. Here are three methods for avoiding capital gains tax on shares.

The Looming Capital Gains Tax Hike The Potential Impact On Businesses And Individuals Sc H Group

The law allows for individuals to defer capital gains taxes with tax planning strategies such as the structured sale ensured installment sale charitable trust CRT.

. The capital gains tax would then be due via Self Assessment. Sale of real estate and apartments. It is designed to encourage investments in small unquoted companies carrying on a qualifying trade in the United Kingdom.

Universal Credit UC is gradually replacing tax credits and some other social security benefits. Instead of taxing it at your regular income tax rate they tax it at the lower long-term capital gains tax rate 15 for most Americans. The 1012 Tax Bracket.

Or if you or your spouse made an election in 1994 to increase the ACB of your cottage by using the 100000 capital gains exemption available at that time. Depending upon the shareholder base the following concerns may need addressing. However there are a number of legitimate reliefs available under the tax legislation which enable shareholders to minimise any liability to tax or defer tax until a physical sale of the shares takes place.

Universal credit is now available across the UK and HMRC state that it is no longer possible for anyone to make a brand-new claim for tax credits. The underlying fund selection can be switched without generating a personal liability to capital gains tax as the switch is done within the bond itself. If you elect to defer the deemed.

In some countries like the US. Non-resident individuals are taxed on Swedish source gains eg. To avoid capital gains tax on the sale of your second home consider making the home your primary residence or exchanging it for another property.

Short-term capital gains are taxed as ordinary income with rates as high as 37 for high-income earners. We pay tax of 20 on any interest and other income received such as rental income from the funds available in the bond. Capital Gains Tax on Rental Property VS.

When you own an asset for more than a year and sell it for a profit the IRS classifies that income as a long-term capital gain. An investor can defer capital gains realised on a different asset where. As previously discussed the resulting gain can be reduced.

Investment income and capital gains are normally taxed at a 30 flat rate. For people in the 10 or 12 income tax bracket the long-term capital gains rate is 0. If the trust has non-UK resident trustees it offers an additional advantage because neither the non-UK domiciled settlor nor any other UK resident beneficiary will be liable to CGT in respect of capital gains realised by the trustees or liable to income tax in respect of non-UK income received by the trustees until a benefit is received.

For example if your completion date for a property disposal is 28 March 2022 then provided you file your Self Assessment tax return for 202122 including the disposal by 27 May 2022 then you will not usually need to file a 60-day return or pay the capital gains tax within 60 days. Here are the long-term capital gains tax brackets for 2020 and 2021. You can also consult the HMRC Capital Gains Tax Manual which contains sections CG63950 to CG64171 that explain the rules in more detail.

Over the ACB and any selling costs is generally a capital gain for income tax purposes. Under the Tax Cuts Jobs Act which took effect in 2018 eligibility for the. The CGT allowance for one tax year in the UK is currently 12300 for an individual and double 24600 if you are a married couple or in a civil partnership.

Less well-known is that it may make sense purely from. Capital gains on Swedish real estate and tenant owners apartments. The IRS allows 250000 of tax-free profit on a primary residenceWhat this means in a simplified sense is if you bought your primary residence for 300000 in 2010 lived in it for 8 years and then sold it in 2018 for 550000 you wouldnt have to pay any capital gains tax.

Defer when you pay Capital Gains Tax deferral relief You will not have to pay Capital Gains Tax immediately if you use your gain from the sale of any asset to make any amount of investment in a. Any dividend income received within a fund from UK equities is not taxed. Tax issues with a share for share exchange.

Long-term capital gains tax rates are 0 15 20 or 28 with rates applied according. By Malcolm Finney Capital gains tax is payable on a capital gain arising on the disposal of most assets. And Canada you can make your second home your primary residence to.

As inheritance tax at 20 may also be chargeable on gifts the ability to defer capital gains tax on the same transaction is a material advantage. The Enterprise Investment Scheme EIS is a series of UK tax reliefs launched in 1994 in succession to the Business Expansion Scheme. A tax rate of 22 applies to the sale of private real property and tenant owners apartments.

Named for the IRS Section 1031 of the IRSs tax code a 1031 exchange is an effective way to defer capital gains taxes on a replacement property when exchanging like. 3 ways to avoid capital gains tax on shares in the UK.

Capital Gains Tax On Sale Of Property I Tees Law

Multifamily Investors Here S Why Cost Segregation Is Your Friend Capital Gains Tax Property Investor Real Estate Investing

9 Ways To Avoid Capital Gains Tax On Commercial Investment Property In 2022 Propertycashin

Avoiding Capital Gains Tax On Real Estate How The Home Sale Exclusion Works 2021

What Is The Etf Tax Loophole And How Is It Used To Avoid Capital Gains Tax

Capital Gains Tax Reporting And Record Keeping Low Incomes Tax Reform Group

Capital Gains Tax In Spain 2022 How Much Do I Have To Pay My Spain Visa

12 Ways To Beat Capital Gains Tax In The Age Of Trump

Capital Gains Tax What Is It When Do You Pay It

The Capital Gains Tax And Inflation Econofact

Tax Advantages For Donor Advised Funds Nptrust

How Are Dividends Taxed Overview 2021 Tax Rates Examples

The Proposed Changes To Cgt And Inheritance Tax For 2021 2022 Bph

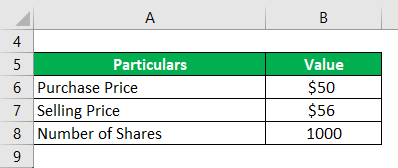

How To Calculate Capital Gain Tax On Shares In The Uk Eqvista

Capital Gains Tax Examples Low Incomes Tax Reform Group

Capital Gains Tax For Individuals Not Resident In The Uk Low Incomes Tax Reform Group

Capital Gain Formula Calculator Examples With Excel Template

How Much Tax Will I Pay If I Flip A House New Silver

Uk Capital Gains Tax For Expats And Non Residents Expert Expat Advice